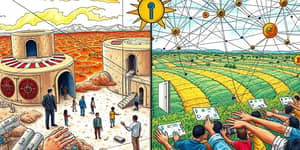

In an age where global challenges—from climate change to social inequality—demand corporate leadership, businesses are reimagining their purpose. Value creation today transcends the simple calculus of profits and losses. It encompasses a broader commitment to stakeholders, society, and the environment. This article explores why and how organizations are adopting a multifaceted approach to value creation, supported by evidence, models, and inspiring real-world examples.

The Evolution of Value Creation

For decades, economic value added served as the gold standard: a company’s ability to generate returns above its cost of capital. Financial statements, investor briefings, and annual reports focused almost exclusively on revenues, margins, and earnings per share.

However, research from McKinsey and Bain reveals that firms prioritizing only short-term profits often sacrifice long-term resilience. In response, a new paradigm emerged—one that integrates social and environmental dimensions. Companies like Microsoft have shifted CEO compensation towards diversity and sustainability metrics, aligning leadership incentives with broader societal outcomes.

Today, a sustainable and stakeholder-driven model is recognized as a critical driver of sustained long-term growth and impact. By expanding the lens of value creation, businesses unlock new opportunities and future-proof their operations.

Stakeholder-Centric Value: Customers, Employees, Communities

Modern enterprises acknowledge that their success is interdependent with the well-being of all stakeholders. Satisfied customers, engaged employees, reliable suppliers, and thriving communities form a virtuous cycle of growth.

- Customer loyalty fuels repeat business and referral growth. Experts estimate that the cost of acquiring a new customer is 5–25 times higher than retaining an existing one, and boosting retention by just 5% can increase profits by 25–95%.

- Employee engagement boosts innovation—Gallup finds that organizations in the top quartile of employee engagement outperform the bottom quartile by 21% in productivity and 22% in profitability.

- Community partnerships foster goodwill and generate shared value. Companies investing in local education, infrastructure, and health initiatives often experience enhanced social license to operate and reduced regulatory hurdles.

By prioritizing transparent communication and fostering trust through continuous feedback mechanisms, businesses build a resilient network of stakeholders. This network not only supports operational stability but also catalyzes collective problem-solving and innovation.

Innovation and Operational Excellence

Innovation and operational excellence are two pillars that underpin value creation. Research from IMD and digitalleadership.com shows that organizations leading in R&D—and those that optimize processes through data analytics and automation—consistently outperform competitors.

Consider Tesla: its relentless focus on battery technology and manufacturing processes has enabled it to scale production while improving margins. Similarly, Toyota’s adoption of lean manufacturing principles revolutionized efficiency, reducing waste and enhancing quality.

By leveraging the UNITE Value Creation Model, executives can trace how resource inputs evolve into tangible and intangible outputs, aligning efforts across functions to maximize overall impact.

The Triple Bottom Line: People, Planet, Profit

The Triple Bottom Line, popularized by John Elkington, urges businesses to measure success across three dimensions: social equity, environmental stewardship, and economic viability. This holistic view resonates with today’s conscious consumers and investors.

Studies by Harvard Business School indicate that sustainable companies often deliver superior financial performance over the long term. For example, Unilever’s Sustainable Living Brands grew 69% faster than the rest of the portfolio and delivered 75% of overall growth in 2018.

Environmental initiatives—such as waste reduction, renewable energy adoption, and sustainable sourcing—reduce costs and mitigate risks. Meanwhile, social programs addressing education, healthcare, and workforce development uplift communities and strengthen brand reputation.

Collectively, these efforts illustrate how people, planet, profit can converge to drive innovation, open new markets, and foster inclusive growth.

Measuring Value: Frameworks and KPIs

Quantifying non-financial value creation is crucial for accountability and strategy alignment. Leading frameworks combine financial metrics with social and environmental indicators to present a comprehensive performance view.

- Economic Value Added (EVA) and Return on Invested Capital (ROIC)

- Net Promoter Score (NPS) and Customer Retention Rates

- Employee Engagement Index and Talent Retention

- Carbon Footprint Metrics and Waste Diversion Rates

Tools like the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB) provide structured reporting guidelines. By tracking measurable business KPIs and outcomes, organizations can benchmark progress, satisfy stakeholder demands, and drive continuous improvement.

Overcoming Challenges: Authenticity and Balance

Pursuing broader value creation is not without obstacles. A rise in greenwashing—where companies overstate or misrepresent sustainability efforts—has heightened the need for independent verification and robust ESG (Environmental, Social, Governance) reporting.

Balancing diverse stakeholder interests also poses strategic dilemmas. Short-term shareholders may clash with long-term community goals or environmental targets. Establishing clear governance processes, stakeholder councils, and adaptive strategies helps navigate these tensions.

Furthermore, CFOs today, as noted by BDO, are expected to champion both financial performance and ESG integration. This dual mandate underscores the importance of cross-functional collaboration between finance, operations, and sustainability teams.

Moreover, rapid digital transformation requires significant investment in data infrastructure and cybersecurity. Yet, organizations that harness technology effectively gain real-time insights, streamline operations, and foster agile decision-making.

Ultimately, authentic stakeholder engagement and transparent practices build trust, mitigate reputational risks, and lay the groundwork for durable value creation.

The Future of Value Creation

Looking forward, value creation will be shaped by emerging trends such as the circular economy, inclusive business models, and cross-sector collaborations. Companies are exploring ways to extend product lifecycles, reduce resource dependency, and co-create solutions with stakeholders.

Innovative partnerships—from public-private alliances to industry consortia—will address complex challenges like climate change, global health, and equitable growth. For instance, IKEA’s furniture take-back programs and resource-as-a-service models are redefining ownership and waste management.

Advances in artificial intelligence and big data analytics will enable personalized products, predictive maintenance, and optimized resource allocation, further enhancing efficiency and impact.

Businesses that embrace a holistic and resilient value creation mindset will unlock transformative opportunities. The imperative is clear: to thrive in an interconnected world, organizations must weave social purpose, environmental stewardship, and financial acumen into their DNA. By doing so, they not only elevate their own success but also contribute to a more sustainable and prosperous future for all.

References

- https://digitalleadership.com/blog/value-creation/

- https://www.imd.org/blog/marketing/value-creation-in-business/

- https://www.bain.com/insights/value-creation-what-it-is-and-why-it-matters/

- https://www.bdo.co.uk/en-gb/insights/business-services-and-outsourcing/finance-function-of-the-future/why-finance-leaders-must-embrace-a-new-form-of-value

- https://www.mckinsey.com/capabilities/strategy-and-corporate-finance/our-insights/the-value-of-value-creation

- https://choicesolutions.com/blog/beyond-the-bottom-line-defining-business-success/

- https://www.synbiobeta.com/watch/redefining-the-bottom-line-value-creation-for-shareholders-and-the-planet

- https://sponsored.bloomberg.com/article/PIF/beyond-the-bottom-line-finding-value-in-operational-efficiency

- https://online.hbs.edu/blog/post/what-is-the-triple-bottom-line

- https://www.pwc.com/gx/en/issues/value-creation.html