When we evaluate a purchase, the initial purchase price often steals the spotlight. Yet the price tag is just the beginning of a longer story. Understanding the sum of all costs—direct and indirect over an asset’s lifecycle reveals the real financial commitment ahead.

By embracing a comprehensive view of total cost, individuals and organizations can make informed purchasing decisions, avoid unwelcome surprises, and maximize return on investment.

Definition and Importance

Total Cost of Ownership (TCO) refers to every cost—visible and hidden—incurred from acquisition through disposal. It extends far beyond the sticker price to include ongoing charges that can eclipse the upfront investment.

Grasping TCO is vital for buyers who want a clear picture of lifetime commitments. It enables apples-to-apples comparisons, drives better budgeting, and supports accurate financial forecasting in any sector.

Key Components of TCO

Every asset or service carries a unique combination of cost categories. Recognizing these elements ensures no expense goes unnoticed:

- Initial Purchase Price: The upfront cost, often the smallest fraction of TCO.

- Operation Costs: day-to-day running costs like energy, labor, and consumables.

- Maintenance & Repair: Expenses for both unscheduled repairs and scheduled services.

- Downtime/Productivity Losses: lost productivity and downtime expenses when assets fail or require downtime.

- Insurance & Taxes: Premiums, property taxes, registration fees, and regulatory charges.

- Financing/Interest: Loan interest, lease charges, or other funding costs.

- Training: Onboarding and upskilling required to use or maintain the asset.

- Upgrades/Replacements: Costs for refreshing hardware, software updates, or adapting to new requirements.

- Disposal & Decommissioning: Safe disposal, recycling, and environmental compliance fees.

- Compliance & Risk Management: Security, regulatory audits, and disaster recovery planning.

Examples Across Industries

Real-world scenarios underscore how varied and substantial TCO can be:

IT Infrastructure: A typical server lifecycle spans five to seven years. Purchase might represent 20–30% of TCO, while electricity can account for up to 30%, maintenance 15–20%, plus support contracts, downtime, and eventual decommissioning.

Automotive Ownership: A $30,000 car can approach a $50,000 TCO over five years. Annual outlays include:

- Fuel: $1,500–$2,000

- Insurance: $1,200–$1,500

- Maintenance & Repairs: $500–$1,000

- Registration & Taxes: Variable by region

- Depreciation: Often 40–50% of value declined by Year 5

Construction & Real Estate: Beyond construction costs, consider utilities, ongoing maintenance, upgrades, property taxes, and insurance. The Facility Condition Index (FCI) tracks deferred maintenance versus replacement value to guide scheduling of capital renewal.

Business Expansion: Adding delivery vehicles means more than fleet price. Factor in driver wages, fuel, insurance, GPS technology, legal compliance, and reputational risk management.

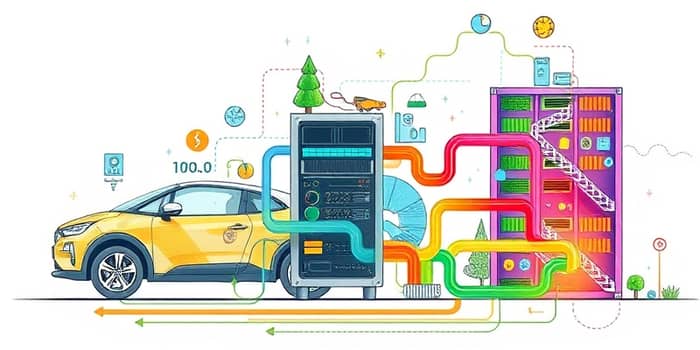

Illustrative TCO Breakdown

Methods for Calculation

Choose the formula that best aligns with your asset type and data availability:

- Basic: Purchase Price + All Lifecycle Costs = TCO

- Expanded: Initial Value + Maintenance + Upgrades + Downtime + Training + Disposal – Residual Value

- Alternative: Direct Costs + Indirect Costs + Hidden Costs – Remaining Value

Practical Steps to Analyze TCO

Follow these steps to ensure a robust assessment:

1. Define the ownership period (e.g., 5–7 years for tech, five years for vehicles).

2. Collect data for all categories, including obscured long-term operating expenses such as energy spikes or unscheduled repairs.

3. Monetize soft costs like user frustration, opportunity costs and diverted resources, and downtime.

4. Leverage industry calculators and tools—e.g., Edmunds True Cost to Own for auto buyers—to benchmark against peers.

Common Pitfalls & Emerging Trends

- Overemphasizing the upfront price and ignoring recurring charges.

- Underestimating hidden costs, such as energy consumption or software support renewals.

- Neglecting downtime impact on productivity and customer satisfaction.

Emerging models like “as-a-service” subscriptions are reshaping TCO by bundling maintenance and upgrades. Eco-sustainability metrics—energy-efficient designs, carbon footprint accounting, and end-of-life recycling—are gaining prominence. Meanwhile, data-driven and automated TCO analysis tools enable precise, real-time cost monitoring.

Why It Matters for ROI

Aligning TCO with Total Benefits of Ownership (TBO) creates a comprehensive cost-benefit analysis perspective. Decision-makers can weigh all benefits—efficiency gains, higher uptime, and improved user experience—against every dollar spent.

By mastering TCO, organizations unlock greater financial clarity and resilience, ultimately fostering more strategic investments and sustainable growth.

In the end, the sticker price is just the prologue. True value emerges when you account for every hidden layer of cost across the journey from purchase to retirement.

References

- https://www.indeed.com/career-advice/career-development/total-ownership-cost

- https://www.pipefy.com/blog/total-cost-of-ownership-tco/

- https://rebim.io/understanding-true-cost-of-ownership/

- https://gethapn.com/blog/what-is-the-total-cost-of-ownership/

- https://www.ibm.com/think/topics/total-cost-of-ownership

- https://toolsense.io/glossary/total-cost-of-ownership/

- https://www.edmunds.com/tco.html

- https://blueprint.fastenal.com/total-cost-of-ownership-the-ultimate-guide.html