Emerging markets present a landscape brimming with potential, offering investors a chance to participate in some of the world’s fastest-growing economies. Yet this promise comes with its own set of challenges. In this article, we delve into how to capitalize on opportunity while safeguarding capital.

By exploring key drivers, potential pitfalls, and practical strategies, you will gain the insights necessary to make informed decisions and build a resilient portfolio.

Defining Emerging Markets

Emerging markets are countries transitioning to developed status, marked by rapid industrialization, expanding financial systems, and rising incomes. They occupy the spectrum between low-income and fully developed economies, often experiencing structural transformation.

Classification relies on several criteria: sustained GDP growth rates and per capita income, export dynamics, ease of foreign investment, and depth of financial infrastructure. Institutions like the IMF and MSCI regularly review nations for inclusion in emerging market indices.

Major examples include China, India, Brazil, Mexico, Turkey, Indonesia, Vietnam, South Africa, and the Philippines. The BRICS group—Brazil, Russia, India, China, and South Africa—captures the largest and most influential names in this space.

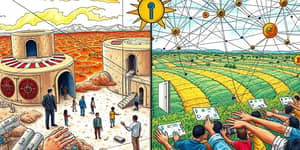

Growth Potential and Opportunities

Emerging markets are forecast to expand by about 4.3% in 2025, outpacing advanced economies at 1.9%. Nations such as India and several Southeast Asian economies could exceed growth rates of 5%, driven by a growing middle class, robust consumption, and significant infrastructure spending.

Digitalization is a game-changer. With a projected $4 trillion global investment in digital transformation by 2027, many emerging economies are rapid technology adoption and leapfrogging, bypassing legacy systems in favor of fintech, e-commerce, and mobile solutions.

- Expanding consumer markets fueled by a rising urban middle class.

- Export growth driven by competitive labor costs and resource advantages.

- Infrastructure development supported by public and private financing.

- Innovative startups leveraging digital ecosystems for rapid scaling.

These drivers can yield high-growth investment landscape for patient investors, providing diversification benefits through low correlation with developed markets.

Navigating Key Risks

Despite attractive returns, investing in emerging markets demands awareness of unique hazards. Political and policy uncertainty can trigger sudden market swings, while currency volatility may erode gains when repatriating profits.

Regulatory frameworks can be uneven, with weak legal protections and opaque corporate reporting. Market liquidity often lags behind developed exchanges, leading to wider bid-ask spreads and challenges in executing large trades.

- Political instability and abrupt policy changes.

- Currency depreciation and repatriation constraints.

- Poor transparency in financial reporting and governance.

- Thinly traded equity and debt markets.

These risks can be substantial, yet they vary widely by country and sector. Thorough due diligence is essential to distinguish manageable risks from those that could imperil capital.

Practical Strategies for Investors

Successful engagement requires a disciplined approach. Building a diversified portfolio can mitigate country-specific shocks. Combining equity, debt, and alternative exposures spreads risk across geographies and asset classes.

- Allocate across multiple countries and sectors.

- Use local currency and hard-currency debt instruments.

- Engage actively with managers specializing in emerging opportunities.

Transparency and data quality differ significantly. Employ global custodians and reputable auditors, request regular reporting, and incorporate third-party risk assessments. Ongoing monitoring helps identify early warning signs of stress.

Risk management tools, such as currency hedges and stop-loss orders, can protect gains while allowing participation in long-term growth trends. For many investors, exposure through ETFs or mutual funds provides broad diversification with professional oversight.

- Implement risk controls via hedging and position limits.

- Emphasize quality issuers and companies with strong governance.

- Maintain liquidity reserves to capitalize on market dislocations.

Conclusion: Balancing Risks and Rewards

Investing in emerging markets is a journey through dynamic economies undergoing profound transformation. By acknowledging both the upside potential and inherent risks, investors can craft strategies that capture growth while preserving capital.

Armed with robust research, disciplined risk management, and patience, you can harness the opportunities presented by these markets. Embrace the challenge with confidence, and watch as disciplined investing in emerging markets contributes to a stronger, more resilient portfolio.

References

- https://www.smartling.com/blog/emerging-markets

- https://primior.com/hidden-risks-of-investing-in-emerging-markets-expert-risk-control-methods/

- https://www.etftrends.com/etf-strategist-channel/new-emerging-markets/

- https://www.idbinvest.org/en/news-media/gems-new-report-shows-risk-investing-emerging-markets-lower-commonly-perceived

- https://corporatefinanceinstitute.com/resources/economics/emerging-markets/

- https://magazine.wharton.upenn.edu/digital/6-risks-of-emerging-markets-investing/

- https://stripe.com/resources/more/emerging-markets

- https://blogs.worldbank.org/en/voices/are-emerging-market-risks-for-private-investors-overstated-what-the-data-show

- https://www.sofi.com/learn/content/what-are-emerging-markets/

- https://hbr.org/2010/04/the-hidden-risks-in-emerging-markets

- https://hellopebl.com/resources/blog/top-emerging-markets/

- https://www.vestedworld.com/perspectives/the-fierce-risks-of-investing-in-emerging-markets-instability

- https://tribeimpactcapital.com/impact-hub/why-emerging-markets-and-why-now/

- https://www.moodys.com/web/en/us/creditview/blog/emerging-markets.html

- https://institutional.fidelity.com/advisors/insights/topics/investing-ideas/why-2025-might-be-the-year-for-emerging-markets