In an era defined by uncertainty—financial crises, natural disasters, and pandemics—economic resilience is no longer optional. It is the foundation for sustained growth and prosperity.

Understanding Economic Resilience

Economic resilience refers to the capacity of an economy to absorb shocks, recover efficiently, adapt, and transform. This concept has gained urgency as global markets face increasing volatility from climate change, geopolitical tensions, and technological disruptions.

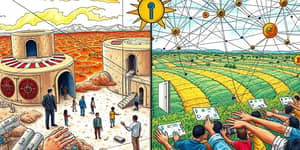

At its core, economic resilience balances immediate response with long-term transformation. It is the difference between an economy that merely bounces back and one that emerges stronger from adversity.

Core Components of a Resilient Economy

Four key components underpin resilience in a market economy. Together, they create a framework for stability and innovation.

- Shock Absorption Mechanisms: Insurance schemes, fiscal buffers, and flexible markets that mitigate immediate losses.

- Adaptive Capacity: The ability of firms and workers to learn, innovate, and shift resources in response to change.

- Rapid Recovery: Infrastructure redundancy and strong institutions that accelerate the return to normal activity.

- Transformative Capacity: Using crises as catalysts for systemic change, such as adopting sustainable technologies.

Determinants of Resilience

Resilience is not accidental; it depends on structural and policy choices that shape an economy’s ability to face adversity.

- Diversified Economic Structure: Reducing reliance on any single sector cushions local downturns and spreads risk.

- Strong Institutions and Governance: Transparent regulations and effective public services build trust and preparedness.

- Flexible Labor Markets: Policies for retraining, mobility, and skill development ensure workers adapt to new industries.

- Robust Financial Systems: Diversified banks, credit access, and prudent regulation prevent systemic collapse.

- Social Safety Nets: Unemployment insurance, healthcare, and targeted assistance protect welfare and support consumption.

Strategies and Best Practices

Building resilience requires deliberate strategies at national, regional, and corporate levels. Leaders must combine planning, investment, and coordination.

- Comprehensive Planning: Involve stakeholders in hazard mitigation and economic development plans, aligning community objectives.

- Supply Chain Resilience: Ensure redundancy, flexibility, and real-time transparency through digital monitoring and partner collaboration.

- Industrial Diversification: Develop new clusters and industries based on unique regional assets and competitive strengths.

- Pre-Disaster Recovery Planning: Define clear roles and rapid-response protocols to restore critical services without delay.

Measurement and Indicators

Quantifying resilience helps policymakers and businesses track progress and allocate resources effectively. Key metrics span macroeconomic to sectoral levels.

Case Studies and Empirical Insights

The 2008 financial crisis demonstrated the power of robust social programs and tight regulation. Nations with well-funded safety nets experienced faster, more equitable recoveries and lower welfare losses.

Similarly, after the 1989 Loma Prieta earthquake, cities with transport redundancy and alternative routes saw significantly reduced economic disruption compared to those reliant on a single bridge or highway.

Emerging Challenges and Opportunities

Three major trends are reshaping the resilience agenda:

- Climate Change: More frequent natural disasters demand green infrastructure and proactive risk management.

- Pandemics: COVID-19 highlighted the need for agile policy response and digital continuity in business operations.

- Digitalization: Real-time data and automation boost transparency and accelerate decision-making under stress.

Implications for Stakeholders

Every actor has a role in forging a resilient economy. Individuals benefit from financial literacy and skill adaptability. Businesses secure market position through product diversification and crisis planning. Governments must foster sound macroeconomic policy and invest in education and infrastructure.

Future Directions and Conclusion

International initiatives such as the IMF's Resilience and Sustainability Trust and OECD guidelines provide frameworks for coordinated action. As resilience employment grows—risk management, sustainability, and digital transformation jobs will be in high demand—economies can achieve competitive advantage by investing now.

By embracing resilience as a core economic principle, communities can navigate uncertainty, protect livelihoods, and unlock opportunities for inclusive, sustainable growth. The path forward lies in collaboration, innovation, and the unwavering commitment to bounce forward with purpose.

References

- https://diversification.com/term/economic-resilience%22%3Eeconomic

- https://pollution.sustainability-directory.com/term/economic-resilience-theory/

- https://www.eda.gov/resources/comprehensive-economic-development-strategy/content/economic-resilience

- https://guild.com/compass/what-is-the-resilience-economy

- https://www.thecommonwealth-ilibrary.org/index.php/comsec/catalog/download/92/89/375?inline=1

- https://www.fourtheconomy.com/post/defining-resilience

- https://www.youtube.com/watch?v=ZCdqqYrIFlc